TRADE FROM

1 TICK SPREAD

TRADE FROM

$0 COMMISSION

UP TO

1:20 LEVERAGE

170+

AKCIE

TRADE FROM

1 TICK SPREAD

TRADE FROM

$0 COMMISSION

UP TO

1:20 LEVERAGE

170+

AKCIE

TRADE FROM

1 TICK SPREAD

TRADE FROM

$0 COMMISSION

UP TO

1:20 LEVERAGE

170+

AKCIE

Trade stocks of major companies

Nabídka

Poptávka

Šíření

*Ceny na této stránce jsou orientační. Ceny nástrojů s nižší likviditou, jako jsou například exotické měnové páry, akcie a indexy, nejsou obnovovány tak často jako běžně obchodované nástroje. Podívejte se prosím uvnitř své platformy MT4/MT5 na nejnovější aktuální ceny

What are stocks?

Stocks, also known as shares or equities, represent ownership interest in a company. When you buy a company's stock, you're purchasing a small piece of that company, including the right to a portion of the company's earnings. Stocks are issued by companies to raise capital in order to grow the business and they can be bought and sold. However, with stock CFD trading, it allows you to speculate on the price movement without needing to own the actual stocks.

How stock CFD trading works

Trading in stock CFDs allows you to speculate on the price movements of company stock without owning the actual shares. If you think the share price is likely to rise, you can simply buy it. If you think the price of the shares is likely to fall, you can sell it.

Bid and ask prices

Otevřete dlouhou nebo krátkou pozici

Stocks are traded in lots

Stock trading involves leverage and margin

Stock trading example

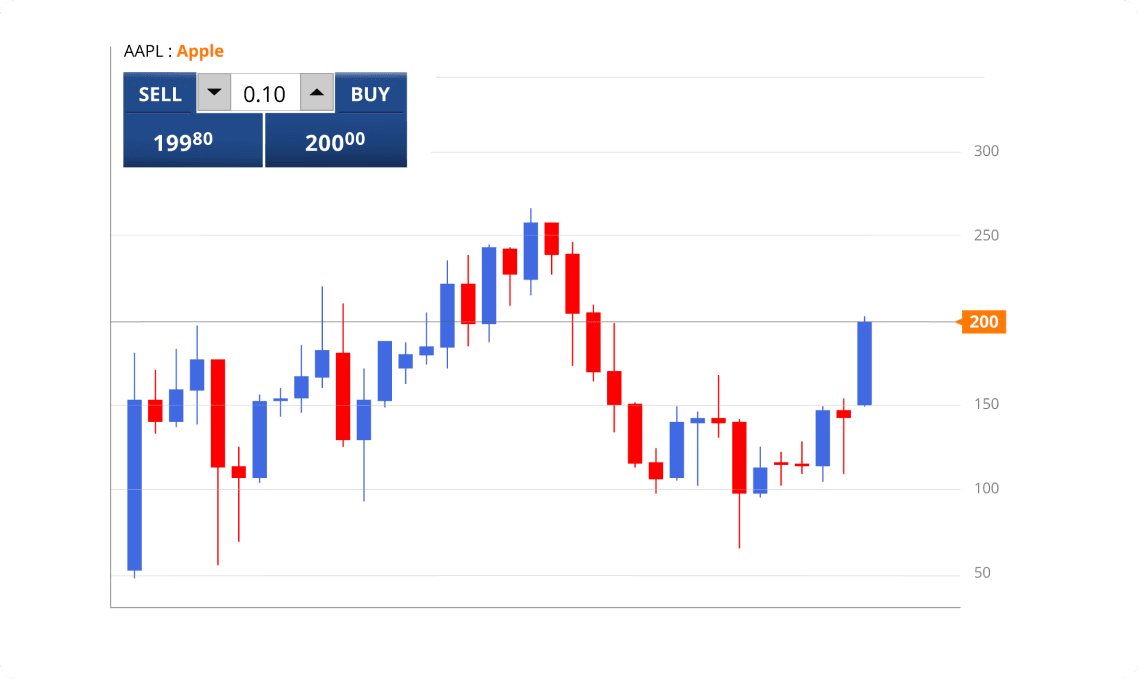

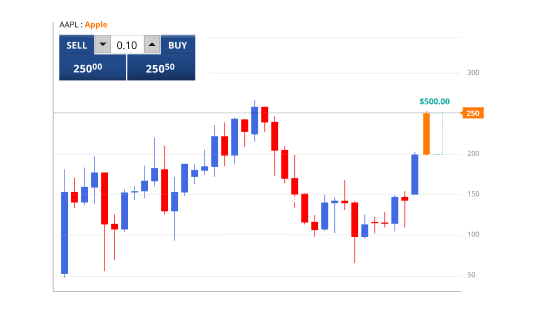

You decide to buy 0.1 lots of Apple (AAPL) at $200 using 20:1 leverage.

0.1 lots = 10 share CFDs of AAPL

10 share CFDs x $200 = $2,000

$2,000 / 20 = $100

Now you have opened a long position in the S&P500 worth USD 22,250. Since futures are traded using leverage, only $225 was used as margin from your trading account. After some time, the price of the S&P500 moves and you decide to sell.

Scenario 1

AAPL moves up from $200 to $250 and you decide to sell.

This is how the profit or loss on the trade would be calculated.

P/L = (Current price - Initial price) x Quantity

P/L = ($250 - $200) x 10

P/L = $50 x 10

P/L = $500

Scenario 2

AAPL moves down from $200 to $150 and you decide to sell.

This is how the profit or loss on the trade would be calculated.

P/L = (Current price - Initial price) x Quantity

P/L = ($150 - $200) x 10

P/L = -$50 x 10

P/L = - $500

Obchodování s vysokou hodnotou s prémiovou službou

To je důvod, proč lidé jako vy volí TIOmarkets

Spready již od 0,4 pipu

Naše agregovaná likvidita umožňuje po většinu doby udržet nízké spready

Nulové provize

Obchodujte od 0 USD za lot na našich VIP Black nebo pouze spreadových obchodních účtech

Nízká počáteční částka

Založte si účet již od 10 USD a začněte obchodovat

Nepřetržitá zákaznická podpora

Jsme tu, abychom vám pomohli, s průměrnou dobou odezvy 3 sekundy na živém chatu

Rychlá exekuce pokynů

Obchody jsou většinou realizovány za několik milisekund a s nízkými prokluzy

Více než 300 symbolů

Obchodujte kdykoli a kdekoli na Forexu, s akciemi, indexy a komoditami

Spolehlivé platformy

Obchodujte na globálních finančních trzích prostřednictvím počítačových nebo mobilních obchodních platforem MT4 a MT5

Obchodování s mikroloty

Obchodujte od 0,10 USD na pip, což je ideální pro malé účty a lepší správu rizika

Získejte více informací o obchodování s TIOmarkets

Trade responsibly: CFDs are complex instruments and come with a high risk of losing all your invested capital due to leverage.