Trade in the Forex market

Buy and sell major, minor or exotic currency pairs

Handel jest ryzykowny

TRADE FROM

0.4 PIPS SPREAD

TRADE FROM

$0 COMMISSION

UP TO

1:1000 LEVERAGE

70+

CURRENCY PAIRS

TRADE FROM

0.4 PIPS SPREAD

TRADE FROM

$0 COMMISSION

UP TO

1:1000 LEVERAGE

70+

CURRENCY PAIRS

TRADE FROM

0.4 PIPS SPREAD

TRADE FROM

$0 COMMISSION

UP TO

1:1000 LEVERAGE

70+

CURRENCY PAIRS

Trade 70+ currency pairs in the Forex market

Go long or short the majors, minors and exotics

Bid

Ask

Spread

*Ceny na tej stronie są orientacyjne. Ceny instrumentów o mniejszej płynności, takich jak, ale nie tylko, egzotyczne pary walutowe, akcje i indeksy, nie są odświeżane tak często jak instrumenty powszechnie handlowane. Proszę sprawdzić w platformie MT4/MT5 ostatnie ceny na żywo.

What is the Forex market?

The Forex market, or the foreign exchange market, is a global marketplace for exchanging national currencies. It stands as the world's largest and most liquid market with an average daily trading volume of $7.5 trillion.

The Forex market is open 24 hours a day, 5 days per week and is split into 3 major trading sessions. Offering unparalleled opportunities and access to traders across the globe.

Forex trading primarily happens over a decentralised electronic banking network and plays a crucial role in the global economy. Serving as an essential medium to facilitate international trade and investments.

How Forex trading works

Forex trading involves the simultaneous buying of one currency and selling of another. For example, if you believe that the value of the Euro will rise against the US Dollar due to strong economic growth in the EU, you might choose to buy the EUR/USD currency pair.

Bid and ask prices

Zajmuj pozycje długie lub krótkie

Forex is traded in lots

Forex trading involves leverage and margin

Forex trading example

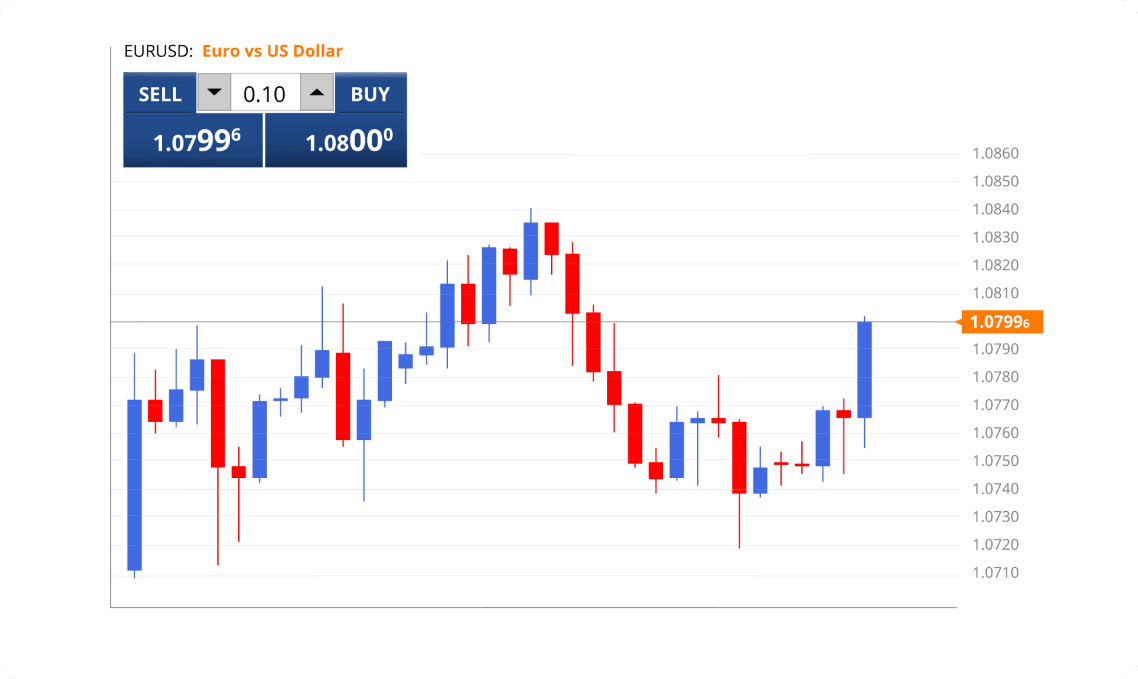

You decide to buy 0.1 lots of EURUSD at 1.0800 using 200:1 Leverage. The two currencies involved in the trade are the EUR and the USD.

EUR 10,000

EUR 1 = USD 1.0800

EUR 10,000 x 1.0800 = USD 10,80

USD 10,800 / 200 = USD 54

Now you have opened a long position in the S&P500 worth USD 22,250. Since futures are traded using leverage, only $225 was used as margin from your trading account. After some time, the price of the S&P500 moves and you decide to sell.

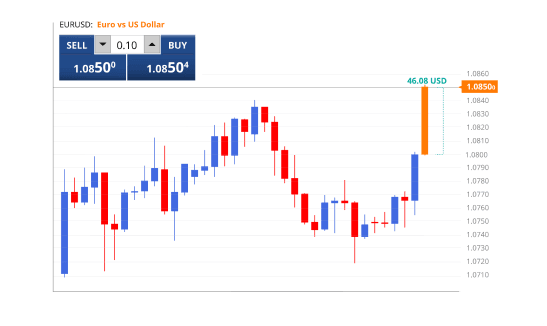

Scenario 1

The exchange rate moves up from EURUSD 1.0800 to 1.0850.

This is how the profit or loss on the trade would be calculated.

P/L = ((Current exchange rate - Initial exchange rate)

x Position value) / Current exchange rate

P/L = ((1.0850 - 1.0800) x 10,000) / 1.0850

P/L = (0.0050 x 10,000) / 1.0850

P/L = 46.08 USD

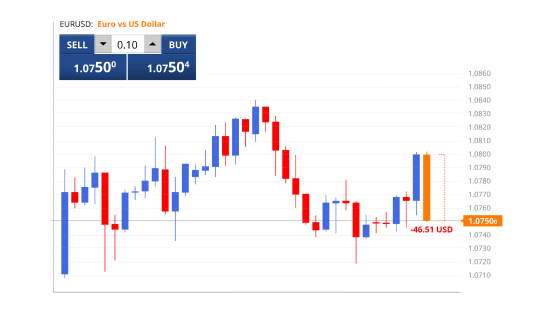

Scenario 2

The exchange rate moves down from EURUSD 1.0800 to 1.0750.

This is how the profit or loss on the trade would be calculated.

P/L = ((Current exchange rate - Initial exchange rate)

x Position value) / Current exchange rate

P/L = ((1.0750 - 1.0800) x 10,000) / 1.0750

P/L = (0.0050 x 10,000) / 1.0750

P/L = -46.51 USD

Handel o dużej wartości z usługą premium

Właśnie dlatego ludzie tacy jak Ty wybierają TIOmarkets

Spready od 0,4 pipsa

Nasza zagregowana płynność utrzymuje spready na niskim poziomie przez większość czasu

Brak prowizji

Trade from $0 per lot on our VIP Black or spread-only trading accounts

Niska kwota początkowa

Otwórz konto już od 10 USD, aby zacząć handlować

Całodobowa obsługa klienta

We are here to help, with 3 seconds average response time on live chat

Szybka realizacja zleceń

Transakcje są realizowane w ciągu milisekund, z niewielkim poślizgiem przez większość czasu.

300+ Symbols

Handel na rynku Forex, akcjami, indeksami i surowcami z dowolnego miejsca i w dowolnym czasie

Niezawodne platformy

Handluj na globalnych rynkach finansowych przy użyciu platform handlowych MT4 i MT5 na komputerach lub urządzeniach mobilnych

Handel mikro lotami

Handluj od 0,10 USD za pips – idealne rozwiązanie dla małych kont i lepszego zarządzania ryzykiem.

Metatrader 4

MT4 został zaprojektowany i stworzony do handlu na rynku forex i futures. Pozwala inwestorom analizować i handlować na rynkach finansowych, testować strategie handlowe, tworzyć roboty handlowe i kopiować innych traderów.

Metatrader 5

MT5 to platforma do handlu wieloma aktywami, która zawiera wszystko, co znajdziesz w MT4. Plus więcej możliwości i narzędzi do analizy technicznej niż jej poprzedniczka. W tym więcej typów zleceń i wbudowany kalendarz ekonomiczny.

Rozpoczęcie pracy jest szybkie i proste

To zajmuje tylko kilka minut, tak to działa

Zarejestruj się

Uzupełnij swój profil i utwórz konto

Sfinansuj

Wpłać natychmiast, korzystając z naszych wygodnych metod finansowania

Handluj

Zaloguj się do platformy transakcyjnej i złóż transakcję

Handel jest ryzykowny

Dowiedz się więcej o handlu z TIOmarkets

Trade responsibly: CFDs are complex instruments and come with a high risk of losing all your invested capital due to leverage.